was hit by cybercriminals who hijacked and redirected its site traffic to a malicious site instead. In 2009, electronic bill payment service provider CheckFree Corp. The breach did not involve financial or banking information, though it did include social security numbers. The enterprise reported that the theft affected 3.3 million people. fell victim to a data breach in 2010 when their “portable media” was stolen. Student loan company Educational Credit Management Corp.

Educational Credit Management Corp.: 3.3 million accounts The tapes had sensitive information, including names, social security numbers, addresses, payment histories, and account numbers, on 3.9 million customers, both current and former, who had applied for personal loans.ĩ. In 2005, CitiFinancial, a subsidiary arm of Citigroup, reported that a box of computer tapes sent over United Parcel Service (UPS) was lost. Here are the top 10 FinServ data breaches, listed from smallest to largest in terms of the number of individuals affected: In fact, the most recent financial services data breach at Equifax affected over 100 million people. Over the years, some of the biggest data breaches have involved financial service providers, from banks and payment processing companies to loan providers and credit reporting bureaus.

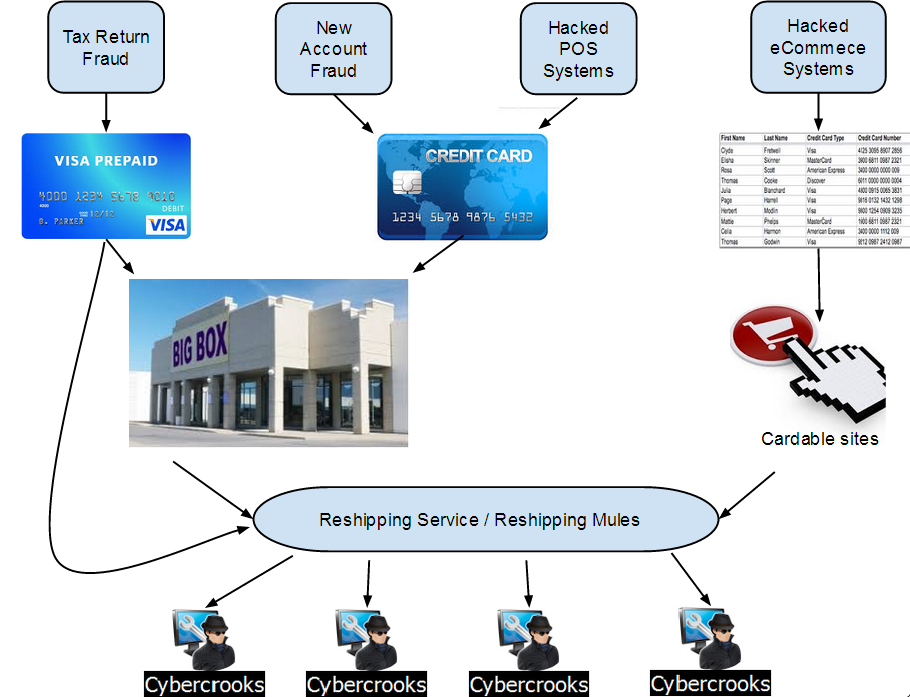

With this data, cyber criminals can open up bank and credit card accounts, file tax returns, and spend your every penny.

These companies possess a wealth of personally identifiable information (PII) and payment card industry (PCI) data, such as social security numbers, credit card numbers, birthdates, addresses, phone numbers, credit scores, and more. Here’s a look at the ten biggest data breaches impacting the financial services industry.Ĭonsumers expect banks and other financial services companies to provide an expert level of security when it comes to their sensitive data, and rightfully so.

0 kommentar(er)

0 kommentar(er)